Empowering New York's Business Growth

SBA Loans Tailored for NYC Entrepreneurs

Unlock the potential of your business with specialized SBA loans designed for New York’s diverse industries. From bustling Manhattan to vibrant Staten Island, Gibor Capital is here to support your entrepreneurial journey.

Please Correctly Check The Box That Applies?

While we lend to virtually any business, we do require at least one year in business.

Do You Have A U.S. Bank Account?

In Order To Fund Your Loan, We Do Require At Least One Year Of Bank Statements.

Please Select How Much You Would Like To Borrow?

How Much Have You Deposited Into Your Business Bank Accounts Last Month?

Select the range that best fits your revenue

What Is The Purpose Of This Loan?

Please select the option that best fits your funding needs/

What Range Is Your Current Credit Score?

We fund loans with credit scores as low as 500, so please don't be affraid to select the correct range

Have You Already Applied For An SBA Loan Somewhere Else?

In Order To Fund Your Loan, We Do Require At Least One Year Of Bank Statements.

Contact us !

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

Our Commitment to NYC Businesses

At Gibor Capital, we specialize in providing SBA loans to New York business owners, understanding the unique challenges they face in this dynamic market. Our mission is to offer accessible financing solutions that empower businesses across the five boroughs and beyond. With a deep understanding of the local economy and a commitment to personalized service, we help entrepreneurs navigate the complexities of securing funding, ensuring they have the resources needed to thrive.

Comprehensive SBA Loan Solutions

Understanding SBA Loan Types and Requirements

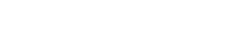

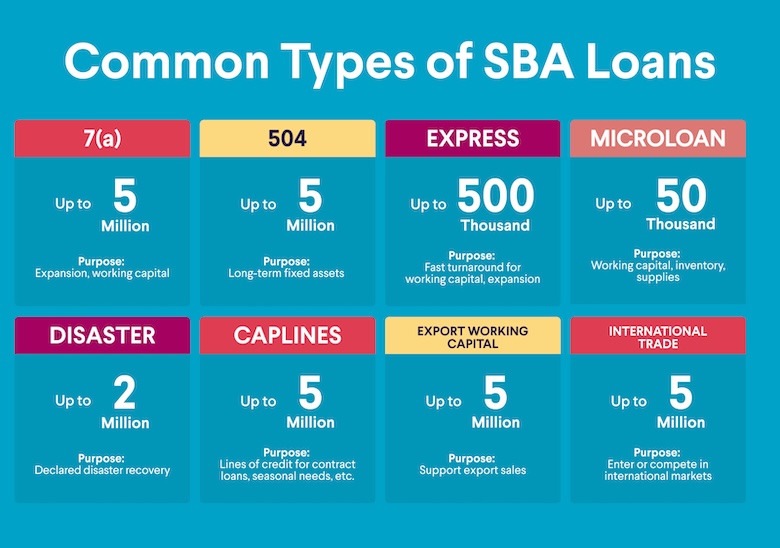

SBA loans are a crucial resource for small businesses seeking to expand, purchase real estate, or manage working capital. The most common types include the 7(a) Loan Program, which offers flexible funding for various business needs, and the CDC/504 Loan Program, ideal for purchasing major fixed assets. Each loan type has specific requirements, such as a solid business plan, good credit history, and collateral. Current interest rates are competitive, making these loans an attractive option for growth-oriented businesses.

To qualify for an SBA loan, businesses must meet certain criteria, including operating as a for-profit entity, conducting business in the U.S., and having reasonable owner equity to invest. Our team at Gibor Capital is dedicated to guiding you through the application process, ensuring you understand each step and have the best chance of approval.

Key Industries in New York City

Restaurants

New York’s vibrant culinary scene is a cornerstone of its economy, with SBA loans helping restaurateurs expand and innovate.

Technology

From software development to AI, New York’s tech sector thrives with SBA support for startups and established firms.

Healthcare and Biotechnology

Hospitals and biotech companies leverage SBA loans for research and development, driving medical advancements.

Real Estate and Construction

With SBA loans, real estate developers and construction firms can undertake ambitious projects across the city.

Retail and E-commerce

SBA financing empowers both physical stores and online retailers to expand their reach and enhance operations.

Hospitality and Tourism

Hotels and entertainment venues utilize SBA loans to upgrade facilities and attract more visitors.

Media and Entertainment

Television and film production companies benefit from SBA funding to create compelling content.

Legal and Professional Services

Law firms and consulting agencies use SBA loans to grow their client base and improve service offerings.

What Our Clients Say

Michael R., Restaurant Owner

Sarah L., Tech Entrepreneur

Dr. James T., Healthcare Provider

Ready to Grow Your Business?

Contact Gibor Capital today to learn how our SBA loan expertise can help your business thrive in New York City.